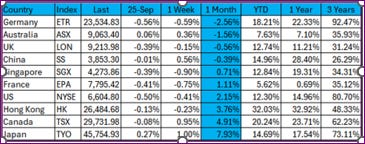

Multi-Period Performance over Top Ten Markets

Executive Summary

Asia, Asia-Pacific & Australia Summary

Top performers: Tech/mining led gains.

Anomalies: Short-term volatility in key stocks.

Recs: Focus on high INST growth names.

UK & European Summary

Top performers: Mining/tech resilient.

Anomalies: Resource sector swings.

Recs: Selective buys in industrials.

US Summary

Top performers: AI/mining strong.

Anomalies: High volatility in tech.

Recs: Momentum in innovative sectors.

Bill Cara’s Perspective & Recommendations

Asia-Pacific markets

Trends show strength in tech and mining sectors with positive momentum in Korean and Chinese stocks, but weakness in consumer goods and financials. High INST scores indicate opportunities in growth-oriented companies amid volatile short-term moves.

These markets showed mixed performance amid China’s stimulus efforts, with Australian stocks impacted by lithium sector volatility. Trading volumes were influenced by broader global cues, including US policy uncertainties, leading to cautious sentiment in Japan and South Korea. Reuters noted gains in mining stocks like Zijin, aligning with CSV’s strong 1-Month % for resource firms, while consumer goods lagged. Bloomberg highlighted Australia’s business growth slowdown due to US tariffs, supporting CSV trends in Origin Energy’s positive momentum. Financial Times reported on regional risks from fiscal shifts, differing from CSV’s high INST in tech like Naver and Xiaomi, suggesting opportunities despite volatility. Overall, stimulus from China boosted select sectors, but trade tensions pose risks; investors should monitor mining and tech for alignment with CSV anomalies.

European stocks

Trends indicate mining and tech resilience, but broader weakness in consumer and financial sectors. High INST scores favor selective industrials amid notable anomalies in resource stocks.

These markets faced pressure from automakers, with declines in luxury and consumer sectors mirroring CSV’s weak 1-Week % for Diageo and LVMH. Reuters emphasized resilient returns drawing global interest, aligning with high INST in Rolls-Royce and ASML amid tech gains. Bloomberg noted September risks from policy shifts, supporting CSV anomalies in Antofagasta’s strong moves tied to mining. Financial Times highlighted outperformance ending due to US uncertainties, differing from CSV’s positive Rio Tinto trends. UK FTSE dipped slightly, reflecting CSV’s mixed financials like Barclays. Investors see diversification appeal in Europe despite valuations, with defense and energy sectors resilient.

US markets

Trends highlight volatility in tech and mining, with strong gains in AI-related stocks but declines in established names. High INST scores suggest momentum in innovative sectors amid anomalies.

The US market fell for a third day, with S&P 500 down 0.5% amid high valuations and AI pullback in Oracle, echoing CSV’s declines in MicroStrategy and Marathon. Reuters warned of shutdown effects on markets, aligning with CSV anomalies in volatile tech like Rigetti. Bloomberg reported rallies from Fed cuts, supporting CSV gains in Nvidia and Palantir. Financial Times noted policy clarity needs, differing from CSV’s strong INST in Alibaba ADR and Apple. Dow slipped 0.4%, reflecting mixed durable goods data. Overall, easing hopes boosted equities year-to-date, but September weakness persists; monitor AI and mining for opportunities.

Processing note: The earling posted article had a corrupted audio file. I usually post these without previewing, and I missed this issue today.