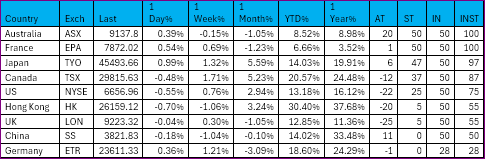

A Review of Tuesday's Global Market Trading

Arming yourself with yesterday’s global market performance provides a decisive edge, illuminating trends and opportunities before the opening bell

A review of Global Market Trading, Tuesday, September 23, 2025

Asia, Asia-Pacific & Australia Markets

Sept. 23, 2025

Asian markets displayed cautious optimism on September 23, 2025, paring early gains as benchmarks in Hong Kong and mainland China retreated amid mixed economic signals, aligning with the CSV’s mixed short-term performance where tech leaders…