The past week’s trade brought more market volatility from the ongoing Trump trade war saga. The S&P 500 finished down -1.3% for the week, the second consecutive week of losses, although the Natural Resources benchmark index eked out a +0.48% gain for the month. Recent trade war fears have weighed more on overseas stocks, as the MSCI World ex-US index slid -2.20% for June. As has become the case, financial market news was dominated by Donald Trump again this week. Markets opened sharply down on Monday after Trump threaten to retaliate with $250 billion in new tariffs against Chinese goods after China promised to retaliate against the initial Trump steel/aluminum tariffs. While this tit-for-tat discourse seems stupid, markets are a bit anxious as a full trade war would certainly cripple the global economy. Our take is that the whole trade war sage will not bring the equity markets down. First, it’s not the snake that you see that bites you. Markets have had six months to price in a trade dispute. Second, Trump, Xi Jinping and other world leaders are not going to let the global expansion rot away on their watch. These leaders were smart enough to get elected and they’ll be smart enough to get re-elected. Separately, as Trump likes to stick his nose in all world affairs, the U.S. President asked Saudi Arabia to increase oil production by as much as 2 million barrels a day due to high prices, a move that would undercut an output agreement reached by OPEC this month. It is unclear if Trump threatened King Salman of Saudi Arabia.

As for macroeconomic data this past week, we didn’t see any signs of trouble for the economy. The final read on U.S. Q1 GDP came in at 2.0%, revised down from 2.2% due to inventory revisions. Consumer confidence remains at the expansion highs, although the June reading edged down a bit (126.4 vs 128.8 in May). We learned that wholesale inventories picked up in May (+0.5%, ahead of estimates of +1.0%), as companies continue to ramp up production. This will eventually translate into inflation, unless something spurs higher consumer demand. Durable goods orders slipped -0.6% in May, although this was mainly due to base effects. The durable goods number still managed to beat economists’ estimates for a decline of -1.0%. As for inflation, the Fed’s preferred measure of PCE came in at 2.3% y/y in May, ahead of the central bank’s theoretical target inflation rate of 2% (ex-energy the number was 2.0% y/y). Knowing that the Fed has the intention of letting inflation run above its target for a while, we see no reason to worry about a faster pace of rate hikes due to inflation at this stage.

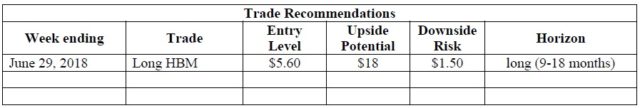

Week’s Trade Recommendation

This week we are beginning a new format for our Weekly Commentaries. While we have been giving our perspective on markets and world events in these Commentaries (hopefully appreciated by readers!), we have had feedback requesting more concrete, actionable trading advise. As such, each week Bill Cara and Owen Williams will propose one trade that stands out to them. After a brief summary of the week’s events, and our two cents on any implications/fallout of the week’s event for investment portfolios or the economy, we will put forth our arguments for the “trade of the week”. The trade may be in any asset class, and we will specify the time horizon and upside/downside objectives for our trade. Moreover, we will remain accountable for the trade, updating previous week recommendations at the end of each Weekly Commentary, until we close out the trade.

This week, we have taken a long position in Hudbay Minerials, a Canadian copper, zinc, gold, and silver miner.

HudBay Minerals (NYSE:HBM) has overcome many negatives in the past year or two, yet the stock price is down -36.4% YTD and -13.3% in the past month. After opening the year at US$9.00 and rising to a high of $10.25 on January 17, HBM dropped to a recent low of 5.25 on Thursday June 28, prompting us to increase our holdings in the Natural Resources portfolio on Friday after having another review.

Many of the important fundamentals we look at are strong. At the current price of US$5.60, PE (ttm) is just 6.5, dropping to just 5.1 with anticipated earnings for the next 12 months. EPS were up +26.2% Y/Y and are anticipated to grow +41.6% next year. Price-to-sales and price-to-book presently are just 0.89 and 0.68 respectively.

Being impressed with these figures, we ran a Discounted Cash Flow analysis which shows a Fair Value of US$9.28 using 15% discount factor and 9% CAGR for EPS.

There Are many reasons we like HBM as a core holding in our Natural Resources portfolio.

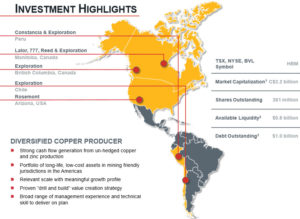

Mining in many parts of the world can be immensely challenging; but HudBay sticks to the mining friendly copper producing jurisdictions of Canada, the U.S., Peru and Chile while avoiding others like DRC, Mongolia and Zambia.

Low copper and zinc prices in 2015 until early in 2016 had an extremely negative impact on HudBay’s ability to earn a profit. Investors were concerned about survivability, noting the large debt to be serviced. Accordingly, HBM’s stock price plunged to a January 2016 low of US$1.56 (from a high of $4.07 that month).

Here are the multiple-year price charts of Copper and Zinc, which are HudBay’s primary production.

Here is a chart of the price of the Copper futures price overlaid on the area chart (blue) of HBM, showing correlation.

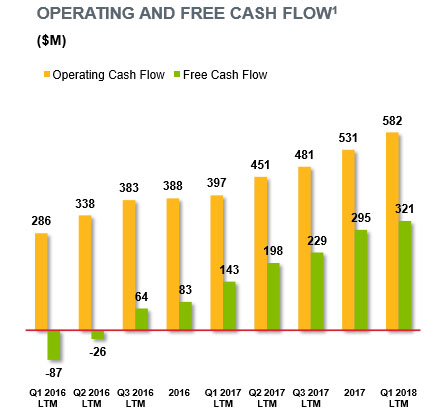

Yes, most investors do know the correction principle, but they might not be aware how much that HBM and Copper and Zinc commodity prices are highly correlated. In fact, at the recent US$3.00/lb Copper price, a +/- $0.30/lb change impacts operating cash flow by +/- $56 million. At a recent $1.30/lb Zinc price, a +/- $0.13/lb change impacts operating cash flow by +/- $32 million.

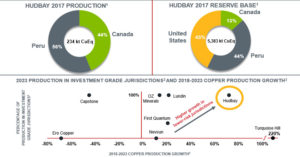

As noted, because of higher Copper and Zinc prices, HudBay is rapidly growing cash flow.

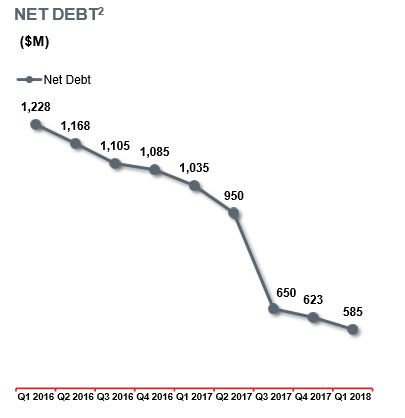

The company is also rapidly paying down debt. A couple years ago, the company’s huge debt was a serious concern of investors, but not now.

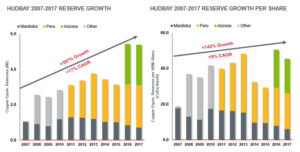

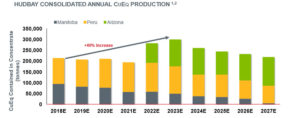

Reserves and Production Growth are key to the company’s sustainability. We have no concerns in this regard.

HudBay is also at the copper mining industry’s lowest end of the production cost curve, which is a factor in sustaining investor interest.

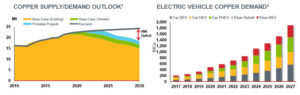

As well as Oil for example, a growing global economy needs copper. Without a continuous growing supply of these two commodities the global economy would plunge into recession and worse. This year, the is a close supply-demand balance – perhaps a bit more supply than demand, which Copper bears are quick to note. But Wood Mackenzie consultants says the near-term surplus amounts to less than 1% of annual production, which is also highly sensitive to supply disruptions.

Looking forward, however, this supply-demand picture changes, particularly with respect to the impact of Electric Vehicles. Copper demand in EV’s will likely grow from 185,000 tonnes in 2017 to 1.74 million tonnes in 2027. By 2030, using figures from existing and probable production sources and the demand outlook, Wood Mackenzie projects by 2030 that there will be a global deficit of 6 million tonnes of copper annually.

Returning to the friendly mining jurisdiction factor, Wood Mackenzie is projecting that between 2019-2035 about 40% will come from DRC, Mongolia and Zambia while only 38% will come from Chile, Peru and the U.S., jurisdictions along with Canada in which HudBay operates.

Going forward for many years, we anticipate a solid financial future for HudBay. We are pleased to hold the stock in our Natural Resources portfolio and added to our position yesterday with purchases both at Interactive Brokers and Schwab.

Some investors will argue that other base metal miners may be a better choice. In fact, this week, in comparing the Growth and Value rankings of HBM stock to all 4117 stocks in our proprietary database, HBM is ranked #981 for Growth and #583 for Value. We have rated the much larger Freeport-McMoRan (FCX) higher at #332 and #273 respectively among the 4117 stocks for Growth and Value. Moreover, Freeport-McMoRan is a perennial favorite in the Cara 100 list of Quality companies and HudBay does not make the list, which we now update quarterly.

But on decision day on Friday, when comparing FCX and HBM, we took note of the severe selling of HBM vs FCX this year. While HBM dropped -13.2% this month, -18.3% this quarter, and -3.5% Y/Y, FCX has made gains throughout the year. FCX gained +2.1% this month, +0.7% this quarter and a spectacular +42.9% Y/Y. Our strategy is to (i) seek Quality and also (ii) buy into weakness. We bought HBM.