As the Trump’s trade tariffs went into effect Friday at midnight, one might have thought that financial markets would suffer on fears of a slowdown in trade and world economic growth. However that would be falling into the “logic trap” in a market that has repeatedly, over the past couple years, done exactly the opposite of what conventional wisdom would suggest. The U.S. equity market closed the week positive, with the S&P 500 up +1.52% and the Nasdaq-100 up +2.31%. The bond market also managed to squeak out gains this past week, with the 30-Year U.S. Treasury perpetual contract up +0.54%. So much for trade war fears. Sell the rumor, buy the news. We would guess the strong performance of risk-on assets reflects market anticipated the tariffs dispute will be short-lived. Should the both China and the U.S. ratchet up the tariffs on more and more goods over the next several months, then we do not see how risk assets can avoid an accident from bubble levels.

Market did get a boost Friday from the U.S. jobs report for June. The U.S. economy created 202k new jobs, ahead of estimates for 190k. A positive surprise, but not enough to justify a +1.0% move in the S&P 500 e-minis. The jobless rate edged up to 4.0% vs. 3.8% in May and 3.8% forecasted for June, again not a data release that explains the strong Friday equity performance in light of a trading war heating up. Earlier in the week, the manufacturing ISM PMI came in strong, 60.2 in June after 58.7 in May. The services ISM PMI similarly surprised to the upside 59.1 in June vs. 58.3 expected. Industrial orders also turned up in May, +0.4% after contracting the prior month. In sum, U.S. manufacturing and jobs data is just fine. Perhaps the macro is keeping the equity market afloat? However, knowing that markets are forward looking, at some point, if tariffs indeed slow global growth, traders will begin selling in anticipation of seeing macro data deteriorate. In other words, selling your equities after getting a couple months of weakening ISM data won’t work for your portfolio (assuming to objective is to grow, not shrink, your account).

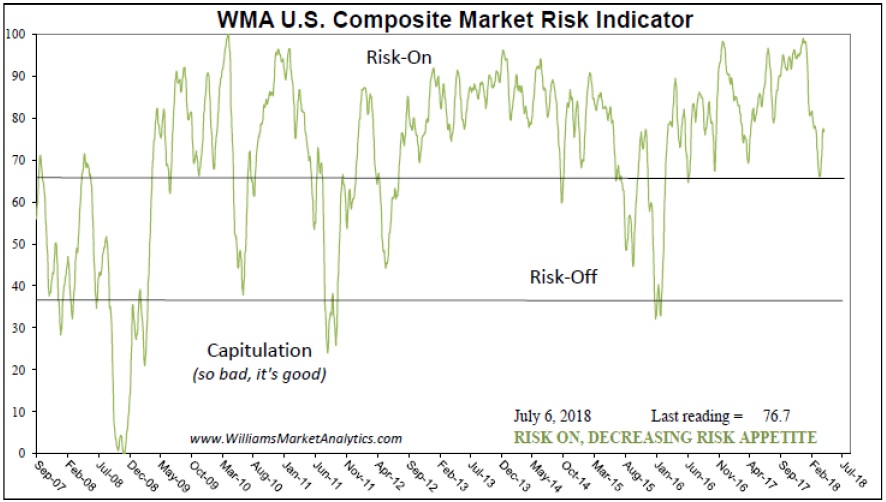

Another possible reason to the week’s equity bounce is that enough pessimism had entered the markets to create a sentiment rebound. Below is our U.S. Market Risk Indicator. At the end of June, the indicator almost got down to Risk-Off. And in this market, that’s good enough to start a buy programme….

As mentioned last week, we have begun a new format for our Weekly Commentaries. While we have been giving our perspective on markets and world events in these Commentaries, we have had feedback requesting more concrete, actionable trading advice. As such, each week Bill Cara and Owen Williams will propose one trade that stands out to them. After a brief summary of the week’s events, and our two cents on any implications/fallout of the week’s event for investment portfolios or the economy, we will put forth our arguments for the “trade of the week”. The trade may be in any asset class, and we will specify the time horizon and upside/downside objectives for our trade. Moreover, we will remain accountable for the trade, updating previous week recommendations at the end of each Weekly Commentary, until we close out the trade. Last week’s call on Hudbay (HBM) was a bit too early, as the stock slid another -4.46% this past week. The drop from the June high is now at -25% for HBM. Hudbay remains highly ranked by our fundamental scores and appears to be an attractive deep value play at current levels. The table at the end the Commentary summarizes our outstanding trades.

Week’s Trade Recommendation

This week we are looking to get long Alamos Gold (AGI) on a pending price break-out.

Alamos Gold operates four North American gold mines with an All In Sustaining Cost (AISC) of about US$950/oz. In addition to the mines there are six low-cost development projects.

Production guidance for 2018 is 490,000 to 530,000 oz of Gold.

The company balance sheet is very strong with zero debt plus $US$232 million cash and US$632 million liquidity support.

At the time of writing, we hold a 7.17% weighted position in the WMA Cara Natural Resources portfolio with a cost basis of US$5.75. Presently the price is US$5.84.

Bill Cara has considered Alamos CEO John McCluskey a friend from the early 1980’s when John was heading investor PR for Chester Millar’s Glamis Gold.

Glamis Gold was one of the world’s first heap leach processors of Gold from extremely low-grade ore. That company grew from literally a plot of land in the Nevada desert to a point in 2006 where Goldcorp acquired it for US$8.6 billion.

In 2003, Chester and John co-founded Alamos Gold. Alamos today, which has long been totally under John’s outstanding stewardship, has a market cap of US$1.76 billion.

Alamos today is a story of growing production, declining costs and increasing profitability as the following illustrations clearly show:

Production and reserves presently are 60% and 57% respectively in Canada, while Mexico represents 40% and 23% respectively. But Alamos also is developing three properties in the higher risk jurisdiction of Turkey.

The Turkey projects are at the permitting stage and represent a potential 375,000 oz/year production and 20% asset NPV by geography. The company estimates that after-tax IRR on the three projects are +44%, +39% and +253%.

The company’s high-quality proven and probable Gold reserves have grown +67% between 2015 (5.9 million oz) and 2017 (9.8 million oz). Reserve life of existing assets is a relatively long 12.4 years.

The Alamos balance sheet is debt-free and strong.

A lot of the Alamos Gold production and reserves resulted from the acquisition of Quebec-based Richmont Mines announced September 11, 2017. Alamos paid C$905 million (US$747 million U.S. at the time) by issuing 1.385 of AGI shares for each RIC share. That reported +22% premium was negatively received as the stock immediately plunged 16%. The price of Gold was about US$1325 at the time vs US$1255 at the time of writing.

In terms of Gold Production, Reserves and Cash Flow per share, however, the Richmont deal resulted in a good deal.

On a value basis of Price/Net Asset Value today, we believe that Alamos represents a powerful case.

AGI closing price this week is US$5.84 on the NYSE and C$7.65 on the Toronto Exchange.

Alamos Gold plans to release its second quarter 2018 financial results after market close on Wednesday, August 1, 2018. Senior management will host a conference call on Thursday, August 2, 2018 at 11:00 am ET.

You might want to tune in.

As noted, we are Alamos Gold shareholders. Given our positive outlook for the price of Gold, we like AGI and the mid-tier Gold producer space that Alamos occupies.

The industry reality is that gold mines today are bought, not found. So, we prefer small- and mid-cap Goldminers to the large cap companies that we believe are likely to be the biggest acquisitions of the smaller gold producers over the new couple years.