With apologies to many other cannabis companies, this article focuses on the 21 of them for which we have been able to capture comprehensive investor-related data. In this article, we show how we capture the data and apply it to a proprietary algorithm to generate portfolio management decision-support information.

Let beauty be in the eyes of the beholder; however, also let every interested investor understand that there is a huge gap between company data as filed with securities regulators and the forward-looking statements, inferences and dreams projected by these companies in their websites and public media exposure.

Without much comment, we will let the data speak for itself. But first you need an explanation.

Every week we compile a couple dozen data points for over 5,000 listed companies. This information is assembled from corporate filings and analyst reports by Thomson Reuters, the premier Big Data company where we retrieve it. In addition to the components of the major indexes (Dow 30, S&P 500, Russell 3000, ACWI 500), we retrieve the same data for hundreds of small cap natural resources companies and other companies in order to study them to trade them in client portfolios.

We also capture the same data now for a growing number of cannabis companies. When more of these companies meet their regulatory requirements and more industry analysts report on them, our database will expand.

Here is a sample of the fundamentals data that we obtain and then massage.

•Y/Y Forecasted Next Year Sales

•Y/Y Forecasted Next Year EPS

•3-month consensus EPS revision % change

•Consensus Est. Enterprise Value-to-EBITBA

•Estimated Net Income-to-Sales

•Net Debt-to-EBITDA

•Cash Flow-to-Total Liabilities

•Current Mkt Cap-to-Forecasted EBITDA

•Current P/BV relative 5-Year Mean P/BV

Once weekly, we run this data for all 5,000+ companies to get relative rankings of any stock against the Universe or its sector or within any peer group we choose such as a portfolio or a group of stocks in an industry like cannabis.

For our purposes today, we used the US stock market tickers for the 21 cannabis companies but later in the article we give the list of Canadian market tickers also and the links to the company websites.

On the fundamentals data we receive, we apply a proprietary algorithm to compute relative scores for categories like Growth, PEG, EPS and Revenue Revisions etc, which will be displayed in this article for cannabis companies.

Here is a description of the Williams Market Analytics Fundamental Scoring System and our Fundamentals algorithm

Scores range from 0 (weakest) to 100 (strongest) and are centered around 50, like a diffusion index, as explained below. The number in parenthesis is the company’s percentile rank for the metric, either versus all listed companies (“Global”) or versus its peers (“Sector”). The 100th percentile is top of class.

NA = Fundamental data is not available for the company or there is a lack of analyst coverage.

| Metric | Components | Significance of 50 level |

| Growth | Y/Y Forecasted Next Year Sales/Current Year Sales Y/Y Forecasted Next Year EPS/Current Year EPS | 50 = 0% aggregate growth rate |

| EPS Revisions | 6-month consensus revision % change (current year) 3-month consensus revision % change (current year) 6-month consensus revision % change (for next year) 3-month consensus revision % change (for next year) | 50 = 0% change in aggregate revisions |

| Sales Revisions | 6-month consensus revision % change (current year) 3-month consensus revision % change (current year) 6-month consensus revision % change (for next year) 3-month consensus revision % change (for next year) | 50 = 0% change in aggregate revisions |

| Valuation | Consensus Est. Enterprise Value-to EBITDA Consensus Est. Enterprise Value-to-Sales For Banks: Total Liabilities & Shareholders’ Equity to-EBITDA Total Liabilities & Shareholders’ Equity to-Revenue | 50 = 50th percentile of each component |

| Profitability | Estimated Net Income-to-Sales Estimated EBITDA-to-Sales | 50 = 0% profit margin for each measure |

| P/E | Estimated P/E for Current Year Estimated P/E for Next Year | 50 = 50th percentile of average forward P/E |

| Financial Situation | Total Debt-to-Total Equity EBITDA-to-Interest Expense Net Debt-to-EBITDA Cash Flow-to-Total Liabilities | 50 = 50th percentile of each component |

| Yield | Indicated Dividend Yield | 50 = 50th percentile of all dividend payers |

| Analyst | Consensus analyst recommendation | 50 = analyst recommendations between Hold and Accumulate |

| PEG | Avg. Est. P/E / In-House aggregate growth rate calculation | 50 = 50th percentile |

| Price/Book Value (historical) | Current P/BV relative 5-Year Mean P/BV | 50 = 50th percentile of all percent spreads |

| Mkt Cap / EBITDA | Current Mkt Cap-to-Forecasted EBITDA | 50 = 50th percentile |

| Price/Earnings (historical) | Current P/E relative 5-Year Mean P/E | 50 = 50th percentile of all percent spreads |

Here is a sample of the output we derive from a combination of the Fundamental and Technical studies.

This illustration dated March 2019 is for the Natural Resources stocks that Owen included in the portfolio he was managing at the time. This month Bill took over the NR portfolio and reduced the market cap maximum to $20 Billion in order to enable Owen to trade large cap NR stocks in his S&P 500 and ACWI Top Picks portfolios.

[embeddoc url=”https://www.billcara.com/wp-content/uploads/2019/05/WMA-Watchlist-2019.04.09-NR-only-1.pdf” download=”all” viewer=”google”]

So, without getting into technical (market price and volume) studies that are part of our decision-support trading process, you can see we have an investment process based on fundamentals.

Now let’s examine the scoring of the 21 cannabis companies we reviewed for this article. The first illustration is of Growth.

From the description of the Fundamentals algorithm, you can see that our Growth score is based on both Revenue and Earnings calculations.

For statistical reasons, we apply a maximum score of 100 to all 5,000+ companies, for all calculations. This methodology resulted in seven of the 21 cannabis companies having 100 scores for Growth and hence receiving a T1 (tied for #1) ranking.

That result reflects the explosive growth in the cannabis industry, particularly in the revenue part of the calculations, if not yet in earnings.

Of the 21 companies, there was insufficient data to calculate scores on four. But of the 17 we scored, fully 16 of these companies scored more than 79.0, which is outstanding, and is the reason so many investors are watching the industry closely.

Without looking further, we found that only Cronos Group (CRON) failed to make the cut on Growth scores.

The lowest Growth score that we found acceptable for investment was Organigram at 79.53, which stood at 237 out of 4,113 ranked companies this week (May 9 data). And yet Organigram ranked only #16 out of 17 of these cannabis companies. Nothing further needs to be said.

Note that the database universe exceeds 5000 companies but the scoring universe for each criterion is less because the reported data from the companies and/or the analysts was insufficient. In fact, for the emerging cannabis industry we were unable to analyze several criteria that we do every week for mature companies.

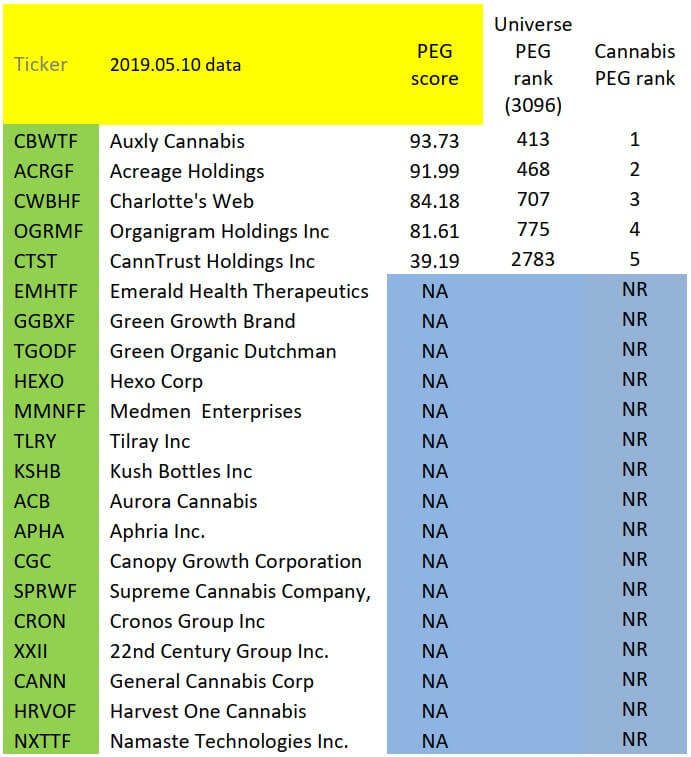

The second illustration is for Price-Earnings Growth.

Here is where Earnings matter and the fact that only five of the 21 companies could be scored shows where investors need to focus. Cannabis companies can either walk the talk that investors want to see, or they cannot.

Of the five scored companies for PEG scores, Auxly Cannabis (CBWTF) was best, followed by Acreage, Charlotte’s Web, Organigram and CannTrust. In the universe of over 5,000 companies of which we were able to score 3096 for PEG, only CannTrust (CTST) failed to make the cut.

Interesting is that some of these companies are being acquired by larger companies, probably to learn the ropes on how to generate earnings.

The third illustration is for EPS Revisions.

Bear in mind that we are not referring to absolute earnings here. When companies guide from a major loss to a lesser loss, the analysts take note.

On this EPS Revisions basis, 15 of the 21 companies received a score, but only three were acceptable for additional study, Canopy Growth (CGC), Green Growth Brand ((GGBXF) and Hexo Corp (HEXO). The best the rest could do against the universe of 3,988 companies that received scores for this measure was Acreage Holdings ranked 2206 followed by CannTrust (CTST) at 2880 down to Cronos (CRON) at 3957.

The fourth illustration is for Revenue Revisions.

Of the 16 companies that we were able to score, Kush Bottles (KSHB) received a T1 (tied for the maximum of 100).

For KushCo, revenue is soaring. Unfortunately, so are losses, which underlies my point that full studies are required – just to examine the fundamentals. Then there are the technicals, and after that the legals (which in the case of KushCo are interesting) and the take-over plays, etc.

Of these 16 companies, investors would take note that maybe only six received scores and rankings that would be acceptable.

The fifth illustration is for Valuation, which we based on the consensus analyst estimates of Enterprise Value (EV) to EBITDA and EV to Sales.

None of the companies made the rankings cut, but Harvest One (HRVOF) was close at 1042 out of 4686, KushCo ranked 2081 and Auxly ranked 2780, which were the next best in order.

Clearly unacceptable.

The sixth illustration is for Price-to-Earnings Ratio (PER).

Only six of 15 companies that we were able to rank scored well. These figures represent the data; however, we take it with a grain of salt.

For these leaders, the scores benefited from estimates of 2019 and 2020 earnings that may or, I am sure, may not come true.

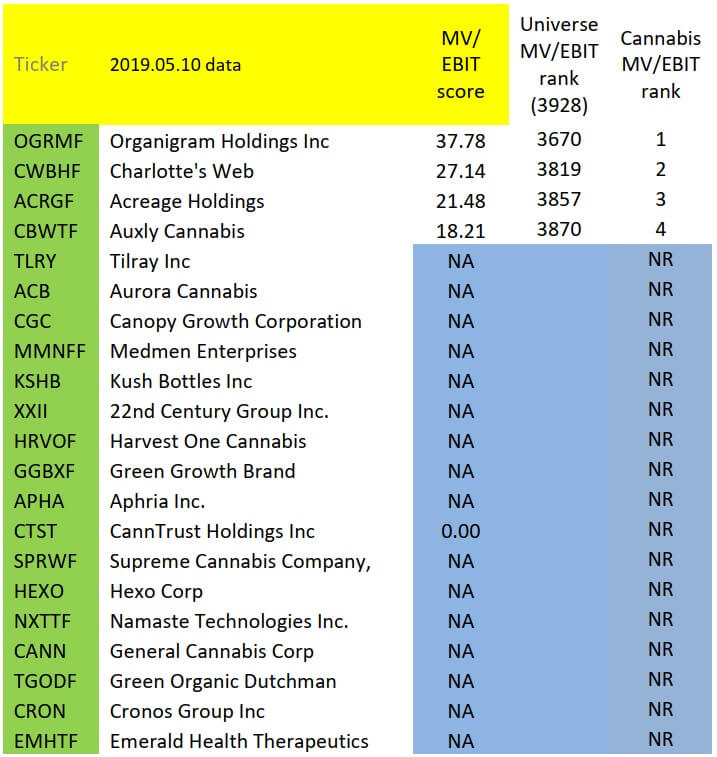

The seventh illustration is for Market Cap to forecasted EBITDA.

Four companies received a MV/EBITDA score, but in each case ranked terribly, from 3670 out of a universe of 3928 down to 3870 out of a possible 3928.

At least the analysts have reported an estimated EBITDA for those companies.

The eighth illustration is related to Book Value.

Twenty of 21 companies were scored. Only Acreage Holdings (ACRGF) did not score.

In the case of Market Price to Book Value analysis, 15 of the 20 scored companies received an acceptable ranking. Green Growth Brand (GGBXF) received a maximum score of 100 (T1 ranking, like many others, in the universe of 4880 companies).

The ninth illustration is for Profitability.

All 21 companies received a score based on estimated net income and estimated EBITDA to Sales.

While all 21 companies did receive a Profitability score, none were acceptable. Only Charlotte’s Web (CWBHF) was close with a 1221 ranking out of the universe of 4630 that we were able to score.

Aphria (APHA) was second best while ranked at 1904 out of 4630 while General Cannabis was lowest ranked (4580 out of 4630).

CannTrust (CTST) was 4th highest ranked of this group of 21 and it was ranked 4238 out of 4630. Clearly not very good.

In our last article, we referred to the lack of green (i.e. Net Income and EBITDA). None of these companies can walk the talk.

The tenth illustration relates to Financial Situation. There are four factors we considered: (i) Total Debt-to-Total Equity (ii) EBITDA-to-Interest Expense (iii) Net Debt-to-EBITDA, and (iv) Cash Flow-to-Total Liabilities.

While all 21 companies did receive a Financials Quality score, only one was acceptable. Charlotte’s Web (CWBHF) received an extremely good ranking of 161 out of the universe of 5021.

Seven more were in the comfortable range of 1151 to 1480 out of 5021. These scores reflect relatively strong capitalization although that situation may not continue for long if their extremely high burn rates are not appropriately managed.

Some of the big names, Aurora Cannabis (3965), Cronos Group Inc (3969), General Cannabis Corp (4501), Medmen Enterprises (4621) and Green Growth Brand (4895), received very low rankings. Too many liabilities and not enough earnings at this point.

The eleventh illustration is of the consensus scoring of all the Analysts who follow the almost 5100 companies that we score and rank on a relative basis each week based on data from Thomson Reuters.

Nineteen of the 21 companies received an Analyst score.

These are not our scores or rankings. We are simply reporting what the industry analysts are reporting, so don’t shoot the messenger.

The ranking out of a universe of 4307 ran from T1st for Green Growth Brand, which although tied with a couple hundred others was excellent, to 19th among the cannabis companies for Cronos Group (CRON) at 4257 in the total company universe, which was not good.

Noteworthy is that fully ten cannabis companies received scores that those analysts consider good or, as we say, acceptable for investing. Perhaps they mean speculating.

In time there will be more analysts covering these cannabis companies, and more companies will be covered. The data, scoring and ranking will continually change. If anything, these analysts, like their legal and accounting colleagues, are likely to become more objective and less corporate finance motivated in their assessments.

The 12th and final illustration in our study series is our proprietary composite score for Growth.

On an objective basis, using the raw data at hand, our studies showed that Acreage Holdings (ACRGF), Auxly Cannabis (CBWTF) and Organigram Holdings (OGRMF) are acceptable for detailed study at this point. However, admittedly those particular scores do go against our biases. We report them here because we rank all companies in our 5000+ company universe the same way.

We also rank companies for Composite Value and Yield, but in the case of these cannabis companies only one ranked (and that was less than acceptable) for Composite Value and none for Yield as none pay a dividend.

We believe that as the cannabis industry is in the emerging growth phase that while we will pay attention to our weekly Fundamental scoring and ranking system, our proprietary Technical algorithms will be more important for decision-support reasons for many months to come.

For us, at some point, we do anticipate offering a cannabis portfolio as an option to clients. To get there, we will be relying on the astute independent valuation work of our associates like Hamid Shekarchi of BDO.

https://www.bdo.ca/BDO/media/Misc-Documents/Cannabis-01May19-Valuations-summary-FINAL.pdf

Like our readers and clients, we are students of the market. Every week is a learning experience and we hope this one was for you as well.

Ticker in Canada | Ticker in USA | Company Name | Webiste |

XXII | 22nd Century Group Inc | ||

ACRGF | Acreage Holdings | ||

APHA.TO | APHA | Aphria Inc | |

ACB.TO | ACB | Aurora Cannabis | |

XLY.V | CBWTF | Auxly Cannabis | |

TRST.TO | CTST | Canntrust Holdings | |

WEED.TO | CGC | Canopy Growth Corp | |

CWEB.CA | CWBHF | Charlotte’s Web | |

CRON.TO | CRON | Cronos Group | |

EMH.V | EMHTF | Emerald Health Therapeutics | |

CANN | General Cannabis Corp | ||

GGB.CA | GGBXF | Green Growth Brand | |

TGOD.TO | TGODF | Green Organic Dutchman | |

HVT.V | HRVOF | Harvest One Cannabis Inc | |

HEXO.TO | HEXO | Hexo Corp | |

KSHB | KushCo | ||

MMEN.CA | MMNFF | Medmen Enterprises | |

N.V | NXTTF | Namaste Technologies Inc | |

OGI.V | OGRMF | Organigram Holdings | |

FIRE.TO | SPRWF | Supreme Cannabis Company Inc | |

TLRY |

CHARTS

XXII

ACRGF

APHA

ACB

CBWTF

CTST

CGC

CWBHF

CRON

EMHTF

CANN

GGBXF

TGODF

HRVOF

HEXO

KSHB

MMNFF

NXTTF

OGRMF

SPRWF

TLRY